All Hail the Silver Bull

Source: Michael Ballanger 10/28/2024

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and how he went from a “silver-hater” to the bullish side of the vessel.

Ever since the heady days of late 2019 when Fed Chairman Jerome Powell decided to go about the task of “fixing” the REPO market by doing an immediate about-face and slashing interest rates, I have remained a stalwart bull on gold prices. During that same period, I have had to indulge in extreme self-medication and mind-control exercises to avoid being lured into the intoxicating world of silver, where bug-eyed zealots roam the countryside donning sidewalk placards extorting the value of silver in what can only be classified as a “religious fervor.”

There is nary a week that goes by without one of their legionaires emailing me a searing ten-paragraph assault on why I “don’t get it” while reciting the nine reasons why silver is going “to da moon! the content of which I have been writing about since the mid-1980s.

However, as the famous John Meynard Keynes is quoted: “When conditions change, I change,” and with the close after Monday’s Crime pit session above $33.50 per ounce, conditions changed.

I cannot count the number of times that silver threatened to “break out” and soar to the dizzying heights of 1980 when it surpassed $50/ounce, only to be obliterated by regulators that used every despicable trick in the book to derail a truly masterful “corner” that the Hunt brothers had put on the silver market. The Wall Street crowd loves to tell tales of how the Hunts got into trouble, but the reality was that if the powers that be had not raised margin requirements to absurd levels in what could only be viewed as an arbitrary and illegal exercise in price manipulation, the Hunts actually did have the silver market completely “cornered” with bodybags at the side of the Crimex pit containing bullion banks hotshots that got in their way.

However, that is another story for another day because just remembering the silver moon rocket event of 1979-1980 is enough to send a sane man to the loony bin, especially with the kind of cheerleading infrastructure that exists online these days.

Avoiding the numerous falso breakouts and costly whipsaws inflicted by silver’s savagery since 2020 and instead sticking to the less-exciting but gradual increases in gold and copper has not been easy.

With those important closing highs last Friday and Monday, leading to a weekly close above the May highs without the widely-anticipated “takedown” that has accompanied silver every single time that it threatened to take on a life of its own, was enough to turn this diehard silver cynic into a torch-carrying, pitchfork-wielding silver bull.

What could silver do over the life of this precious metals bull market?

Let me dovetail back to the analysis to which I referred in 2020 regarding the linkage between the U.S. debt level and the gold price. If one might assume that gold will eventually be used to collateralize U.S. debt to the tune of 10%, then gold will need to be re-priced. The total national debt (less entitlements) is estimated to be approaching $36 trillion. Based on estimates by the World Gold Council, the U.S. Treasury owns 8,311 metric tonnes or 18,317,444 pounds or 293,079,104 ounces of gold.

Therefore, by dividing $36 trillion worth of debt by the total ounces alleged to be held within the walls of Fort Knox, you arrive at $122,859 per ounce. Collateralizing that debt at a rate of 10% would put the price of gold at $12,285 per ounce, a realistic value designed to allow foreign investors to reduce sovereign default risks by owning collateralized U.S. treasuries.

The ratio of silver to gold in nature, according to the World Silver Institute, is 19 parts silver for every 1 part gold. However, the low for the ratio in 2011 (the last time silver challenged $50/ounce) was 39:1. Twice between 2016 and 2021, the GSR plunged to under 65:1 and last May it hit 74. At the current ratio of 81.55:1, that allows for a move to $37.22 to match the May levels; it allows for a move to $42.50 on a move to the 2015 and 2016 lows, and a move to $70.60 at the 2011 lows. That also assumes that gold makes no meaningful progress beyond the current level of $2,754.60.

However, if one assumes that gold gets collateralized at 10% of the per-dollar-of-debt number of $12,285 per ounce, then a move to the 2015-2021 GSR lows would be $189.58 per ounce, and if we get a drop to the 2011 lows at 39, the number for silver is $315 per ounce.

For the time being, I am setting my 2024 target for silver based on a $3,000 gold price, but with the final thrust of the precious metals bull taking the GSR to 64.8, inferring that silver will see $46.30 during this run.

That would take my current holdings in the iShares Silver Trust (ETF) (SLV:NYSE) (bought at $30.97 last week) to around $43 and the December $30 calls to about $13.00 from the current $2.15.

My only silver junior is Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA) run by Chairman Michael Williams where they are developing the Berenguela silver-lead-manganese project in Peru. It should be noted that billionaire Eric Sprott owns 25% of the issued capital of AAG/AAGFF.

So there you have it. I know my inbox will again be stuffed with two dozen reasons why my target price is “ridiculously low” and four dozen reasons why I “don’t get it,” but following the infinitesimal wisdom contained in the phrase “once bitten, twice shy,” my advancing age has forced me to be less aggressive in my speculative forays into the enticing world of silver ownership.

To have “conditions” change enough to force this former silver-hater to the bullish side of the vessel is a testimonial to the strength contained in this all-encompassing precious metals bull and to the relative strength that silver is finally demonstrating, a middle finger of both hands thrust forcibly into the faces of the ever-dangerous bullion bank behemoths. It comes at a particularly opportune time.

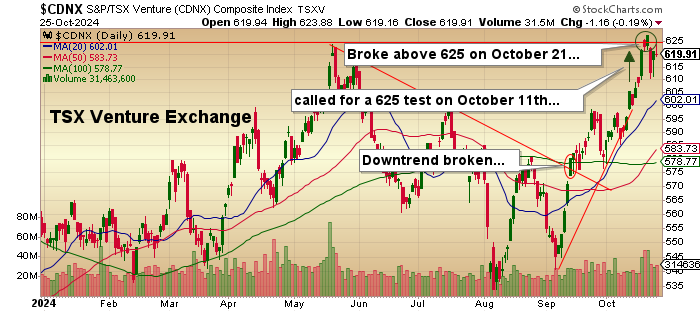

TSX Venture Exchange

The TSX Venture Exchange is finally breaking free of the shackles of a disinterested, disengaged investor pool at the 625 resistance level of which I spoke a few weeks back that has been surpassed at long last. The 1,025-1,100 level is the next stop, assuming, of course, that the TSXV participates in the year-end love fest that most surely will follow the American elections.

With over $1 trillion of authorized buybacks filed going into November, once this earnings parade is over, I see the possibility of a melt-up right through to mid-January, especially if we see a Trump victory. That should have an ancillary effect on the TSXV, which looks poised to test the highs of 2021 and 2022 above 1,000.

That should (there is that operative word again) take the basket of junior gold-silver-copper juniors up and out of the funk in which they have been mired since late 2022. I am looking for big news from Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), where recent reports suggested the completion of the much-anticipated Preliminary Economic Assessment for their Fondaway Canyon gold deposit. It is my expectation that a robust PEA will attract deep interest in the project with particular attention being paid by the large Nevada producers looking for additional feed for their mills.

I am also looking for news from Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB), whose due diligence period pertaining to the Ptolemy Mining “letter of exclusivity” announced on June 27 is almost complete.

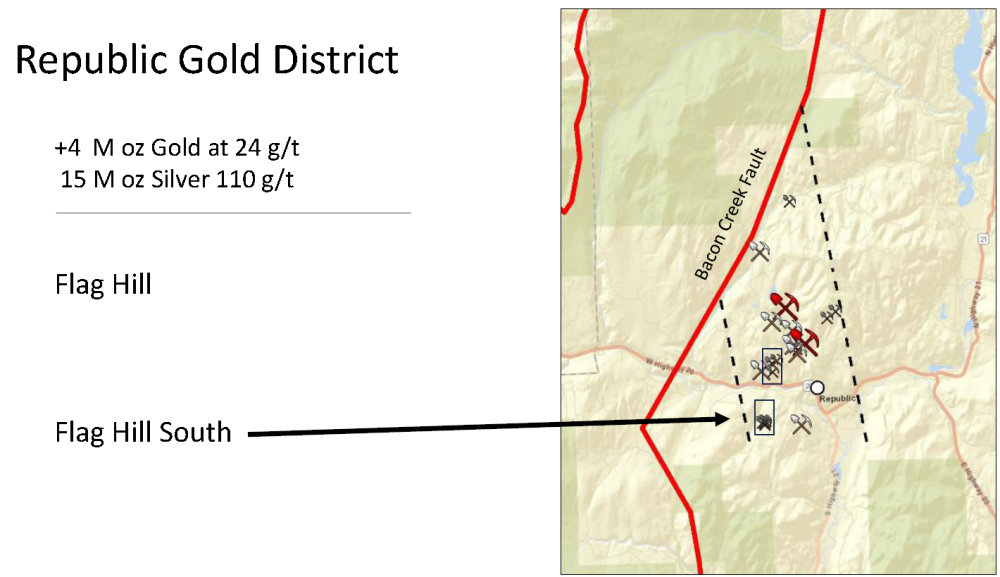

Lastly, while I have tried to avoid grassroots explorers in favor of “advanced exploration” or “resource development” deals in recent years, thanks largely to the challenged nature of the junior mining space, I am adding a new name to the list. Adamera Minerals Corp. (ADZ:TSXV;DDNFF:US), run by CEO Mark Kolebaba, is a company in the hunt for high-grade gold in the historically high-grade Republic Gold District of Washinton State. I had a series of in-depth discussions with Mark this past week, and I like what I hear.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Source: https://www.streetwisereports.com/article/2024/10/28/all-hail-the-silver-bull.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.